In the realm of private placements, the Securities and Exchange Commission (SEC) provides certain exemptions to companies seeking to raise capital through the issuance of securities. Two commonly used exemptions are Regulation D Rule 506(b) and Regulation D Rule 506(c). While both exemptions fall under Regulation D, they have distinct characteristics and requirements. Let’s explore the differences between 506(b) and 506(c) deals:

About 506(b) Deals:

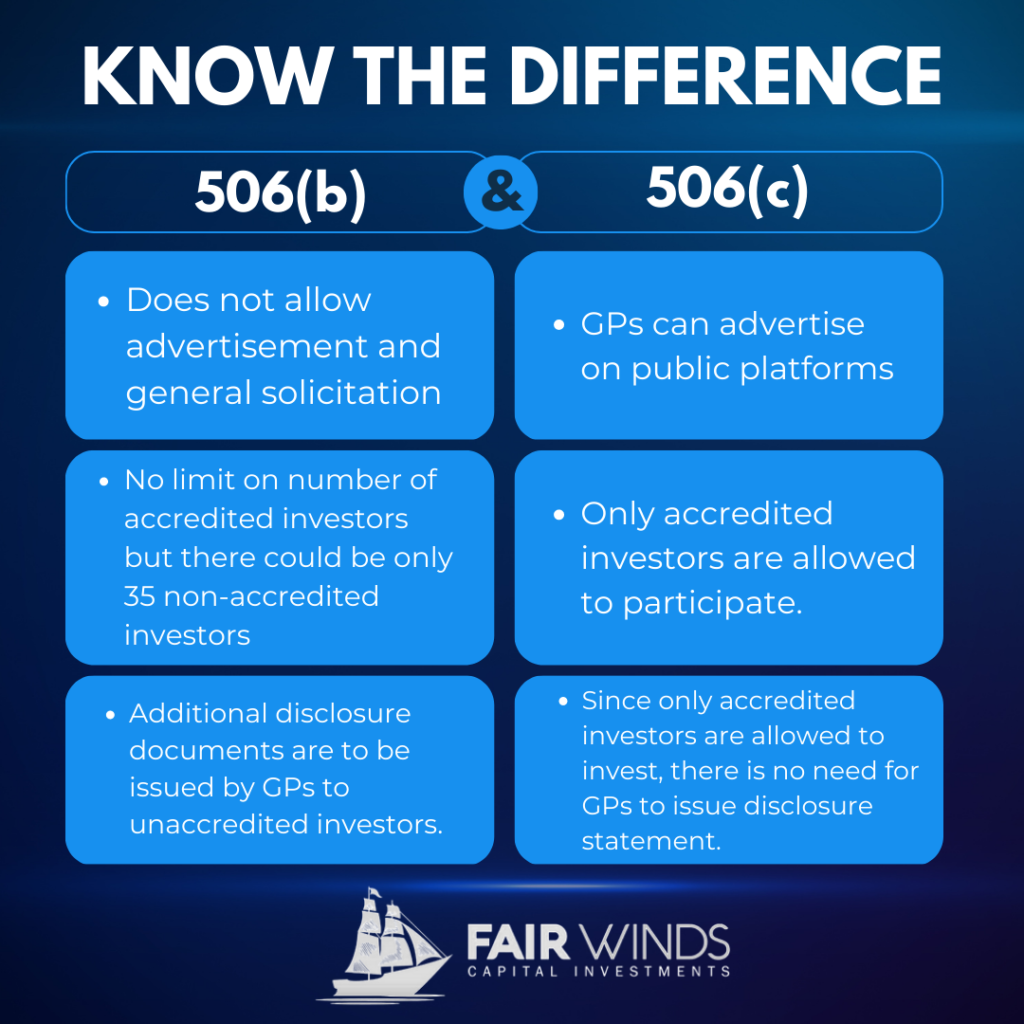

- Accredited Investors and Limited Non-Accredited Investors: Under Rule 506(b), companies can raise capital from an unlimited number of accredited investors (high net worth individuals or institutional investors) and up to 35 non-accredited investors. However, companies must verify that the non-accredited investors are “sophisticated” and have sufficient knowledge and experience in financial and business matters.

- General Solicitation Prohibited: One significant aspect of 506(b) offerings is that issuers are prohibited from using general solicitation or advertising to attract investors. This means that companies cannot publicly promote their offerings through advertisements, social media, or any other form of mass communication.

- Information Requirements: While there is no requirement to provide specific information to accredited investors, companies must provide all non-accredited investors with extensive disclosure documents, similar to those used in registered offerings.

- Resale Restrictions: Securities purchased in a 506(b) offering are subject to certain resale restrictions. Non-accredited investors typically face limitations on reselling their securities to prevent widespread distribution.

About 506(c) Deals:

- Accredited Investors Only: Unlike 506(b), Rule 506(c) deals exclusively with accredited investors. Companies conducting 506(c) offerings can raise capital from an unlimited number of accredited investors, but no non-accredited investors are allowed to participate.

- General Solicitation Allowed: One significant advantage of 506(c) offerings is that issuers are permitted to engage in general solicitation and advertising. This means companies can openly promote their offerings to a broader audience through various channels.

- Strict Accredited Investor Verification: To ensure compliance, companies conducting 506(c) offerings must take reasonable steps to verify that all investors are accredited. Verification can involve reviewing financial documents, tax returns, or obtaining written confirmation from a qualified third-party.

- No Information Requirements for Accredited Investors: Companies are not required to provide specific disclosure documents to accredited investors, as they are presumed to have the financial sophistication to evaluate the investment opportunity.

| Aspect | Regulation D Rule 506(b) | Regulation D Rule 506(c) |

|---|---|---|

| Types of Investors | Accredited Investors + Limited Non-Accredited Investors | Accredited Investors Only |

| Maximum Number of Non-Accredited Investors | Up to 35 non-accredited investors | None |

| General Solicitation Allowed | No | Yes |

| Verification of Accredited Investors | No specific verification required for accredited investors | Strict verification required for all investors |

| Information Requirements for Non-Accredited Investors | Extensive disclosure documents required | No specific information requirements |

| Resale Restrictions | Limited resale restrictions for non-accredited investors | No specific resale restrictions |

Conclusion:

In summary, the choice between a 506(b) and 506(c) offering depends on the issuer’s preference, the type of investors they wish to attract, and their advertising strategy. 506(b) deals offer more flexibility in terms of accepting non-accredited investors but require compliance with stricter information requirements and a ban on general solicitation. On the other hand, 506(c) deals limit investors to accredited individuals only but allow issuers to openly advertise their offerings to a wider audience. Companies should carefully evaluate the pros and cons of each exemption to determine which best aligns with their fundraising objectives and investor relations strategy.

![An In-Depth Look at Jake and Gino's Coaching Program [A Review]](https://allaboutmultifamilyinvesting.com/wp-content/uploads/2023/10/AAM-BMP-Blog-Covers-750-×-422px-6.jpg)

![Email Marketing Tips for Multifamily Real Estate Syndicators to Raise Capital [Templates included]](https://allaboutmultifamilyinvesting.com/wp-content/uploads/2023/09/AAM-BMP-Blog-Covers-750-×-422px-4.jpg)

![The Richest Kids In America [Book Review]](https://allaboutmultifamilyinvesting.com/wp-content/uploads/2023/09/AAM-BMP-Blog-Covers-750-×-422px-84.jpg)